About fifty miles into my ride home to Austin, text messages begin popping up on my phone. Did you make this $300 purchase from Home Depot? H-E-B? Netflix?

I pulled over to call my bank’s Fraud Department.

“Your card has been compromised,” says the agent, “It’s blocked.”

The number had been skimmed at the gas pump with a device that fits over or inside the card reader at the Pilot station off I-10 in Ft. Stockton.

I protested. “I have 300 miles to go and that is the only card I brought with me to buy gas.” It was a rookie move, for sure.

In hindsight, I could have avoided card skimming at the pump in a few ways:

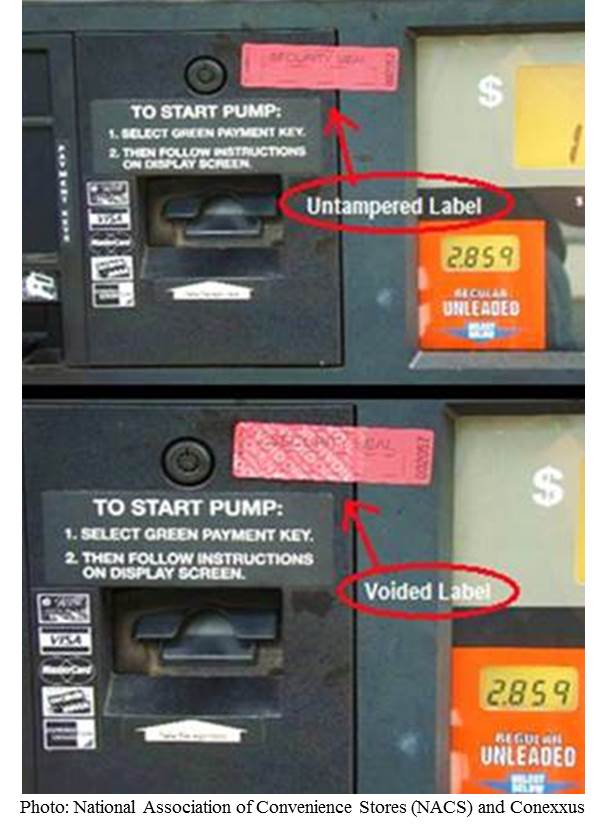

- Checking the pump’s card reader for security tape (if any) to be sure the seal has not been broken.

- Going inside to pay the cashier for gas.

- Using my phone banking app to turn my card on and off as needed.

I hadn’t done any of those things, and now I was on the roadside in the desert one hot and sunny Sunday afternoon.

Lesson learned— again. I should always have two forms of payment (preferably stored in different locations) and carry enough cash to get me home.

Another variation of the dreaded card block bears mention. Banks have blocked my cards, sometimes without warning, when transactions occurred in multiple cities or states over a short period. Calling ahead to put a travel notice on cards has helped avoid that headache.

My story does end well. At the time my card was blocked, I had a full tank of gas and I discovered a $20 bill squirreled away in my saddlebags. Although I had to ride slowly (sort of) to conserve gas for the next five hours, it was enough to get me home.